By: Chase Howard

By: Chase Howard

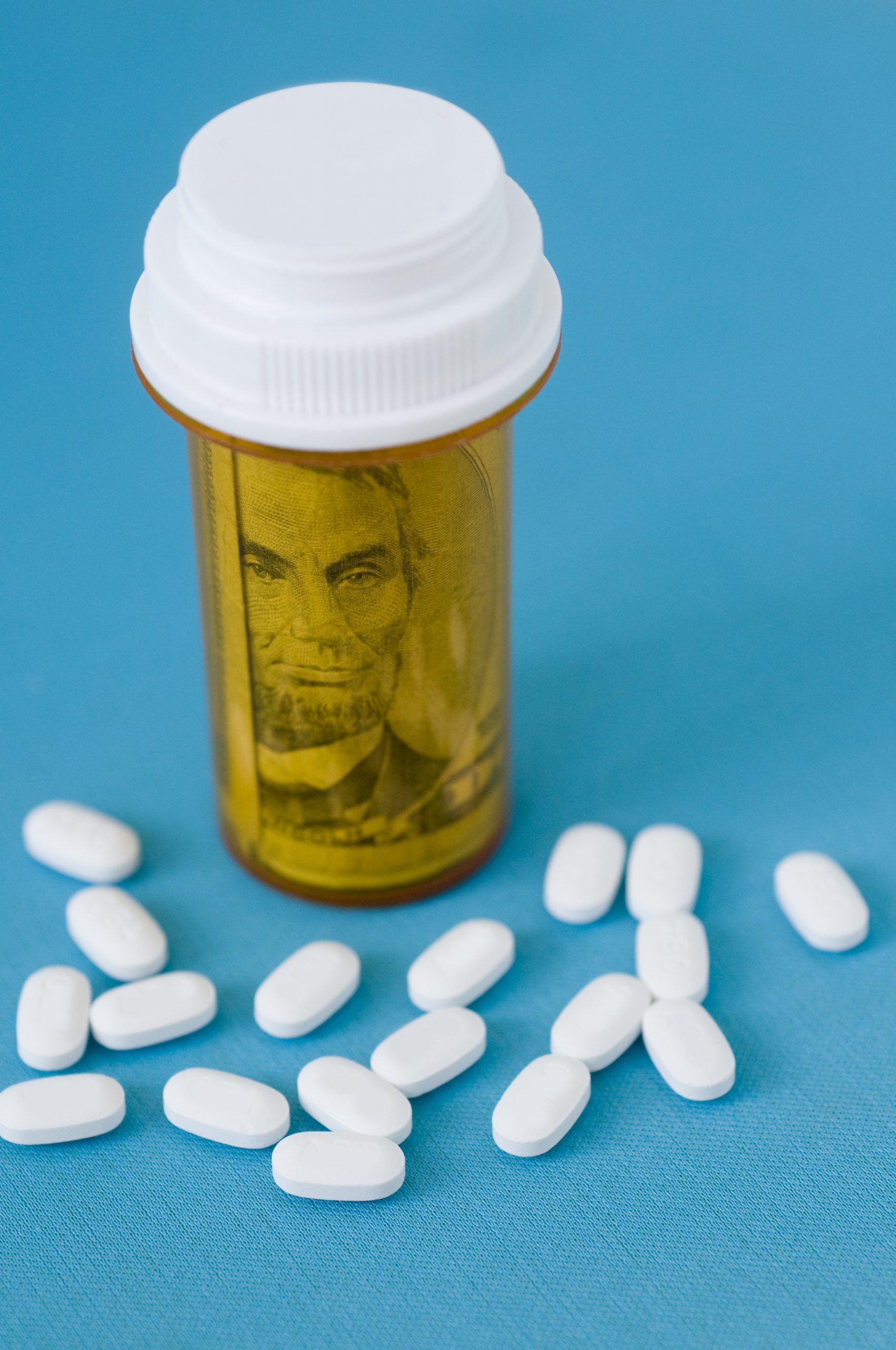

Those in the practice of dentistry today have many options when it comes to building a practice. Should you work for an employer? Build your own? What about buy a practice? More and more, we see young dentists wishing to avoid private equity and buying out a retiring dentist’s practice. The amount of regulation imposed upon those entering into the dental practice arena can be staggering. Further, buying a dental practice requires many considerations that are unique to other areas of business. Understanding the purchase process will help protect your investment and could keep you from experiencing any unnecessary liability.

First, organize a team of specialized dental experts, such as a dental CPA, Professional Practice Lender, dental law attorney, and a practice consultant. Having a team of professionals guide you through all aspects of the deal will keep you on track, avoid potential issues, accomplish specific task items, and properly comply with any legal considerations.Continue reading

By:

By:

By: Karina Gonzalez

By: Karina Gonzalez

By:

By:

By:

By:

By:

By:

By:

By: