- Prepared by: Carlos Arce, Esq.

- Florida Healthcare Law Firm

In business, it is well established that compliance is the key to continuity. In healthcare business, compliance is actually the foundation for revenue. One of the most overlooked, yet easiest, compliance elements healthcare professionals need to focus on when starting up or acquiring a healthcare business are the patient intake forms.

Patient Intake Forms

Compliant patient intake forms should contain elements including, but not limited to: the commencement to patient medical records, patient privacy policies required by HIPAA/HITECH, patient financial responsibility and assignment of benefits, patients’ bill of rights (which are required to be provided by law), patient medical record authorization forms, informed consent over medical care and the use of telehealth.

Nothing listed above is an item that can be overlooked. Each document plays a key role in compliance, which ensures the generation and protection of revenue. Proper patient intake forms are needed across the gamut of healthcare, from the medspa setting through to hospitals. Improper documentation can result in claims denials from payors or possibly a privacy law violation with the Office of Civil Rights.

One of the most common compliance issues with patient intake forms is missing or incomplete privacy rights disclaimers, effectively creating patient populations who are unaware as to how their protected health information (“PHI”) will be utilized or what their provider can or cannot share. Huge liability. Patient intake form requirements also run parallel with posting requirements in the office, which are also routinely overlooked when the intake form foundation is lacking. Patient bill of rights, privacy notices, good faith estimate compliance, and certain fraudulent billing disclaimer language is required for many types of healthcare providers.

Using copies or documents replicated from other health care businesses is a common pitfalls and easy way to miss crucial elements. Forms that are canned or have been reused often fail to account for and include new legal changes as well as the everchanging vital information and requirements dictated by federal and commercial payors. Providers need to evaluate what their current intake forms need to include, what their current set has, and decided whether editing is appropriate or simply creating a brand new updated set.

With the influx of Spanish speakers in today’s South Florida market, in particular, it is also wise to create and provide these vital forms in a duplicate Spanish version. The last thing a medical provider needs is their informed consent form being invalidated because the patient couldn’t read it.

- Attorney Carlos H. Arce works with the Florida Healthcare Law Firm in Delray Beach, FL. He has deep experience with health law, business law, and mergers & acquisitions. Carlos has handled multi-million-dollar healthcare transactions and has served as out-of-house counsel to various small to large healthcare entities. He can be reached via email at [email protected] or by calling 561-455-7700.

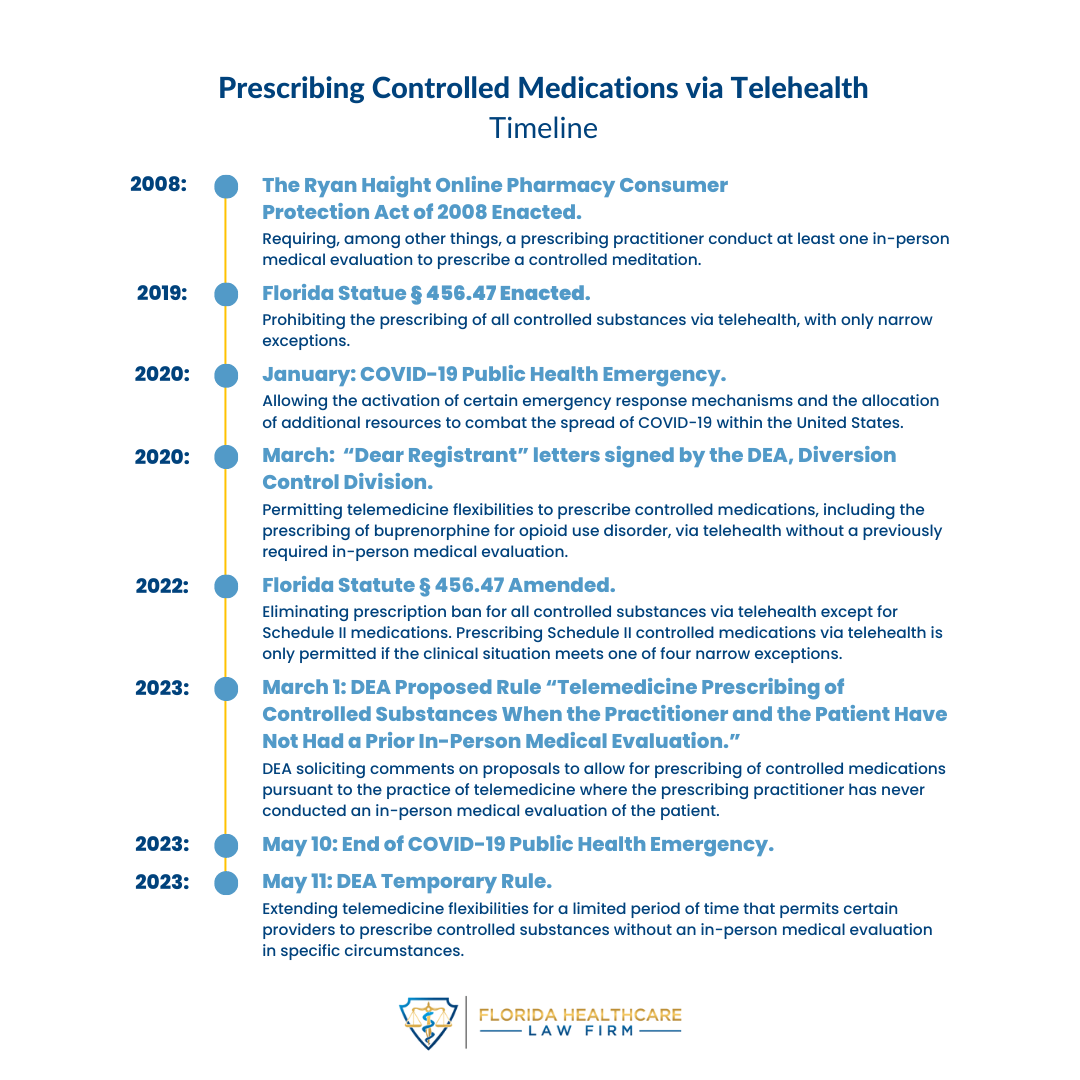

In its latest Temporary Rule, the Drug Enforcement Administration (“DEA”) extended its rule in response to the COVID-19 Public Health Emergency (“COVID-PHE”) permitting authorized providers to prescribe controlled substances without an in-person medical evaluation in specific circumstances (referred to as, “telemedicine flexibilities”). The DEA extended the telemedicine flexibilities for six months from May 12, 2023, through November 11, 2023, subject to certain conditions. If a patient and a practitioner have established a telemedicine relationship on or before November 11, 2023, however, the same telemedicine flexibilities that governed the relationship to that point are permitted until November 11, 2024.

In its latest Temporary Rule, the Drug Enforcement Administration (“DEA”) extended its rule in response to the COVID-19 Public Health Emergency (“COVID-PHE”) permitting authorized providers to prescribe controlled substances without an in-person medical evaluation in specific circumstances (referred to as, “telemedicine flexibilities”). The DEA extended the telemedicine flexibilities for six months from May 12, 2023, through November 11, 2023, subject to certain conditions. If a patient and a practitioner have established a telemedicine relationship on or before November 11, 2023, however, the same telemedicine flexibilities that governed the relationship to that point are permitted until November 11, 2024.