By: Michael Silverman

By: Michael Silverman

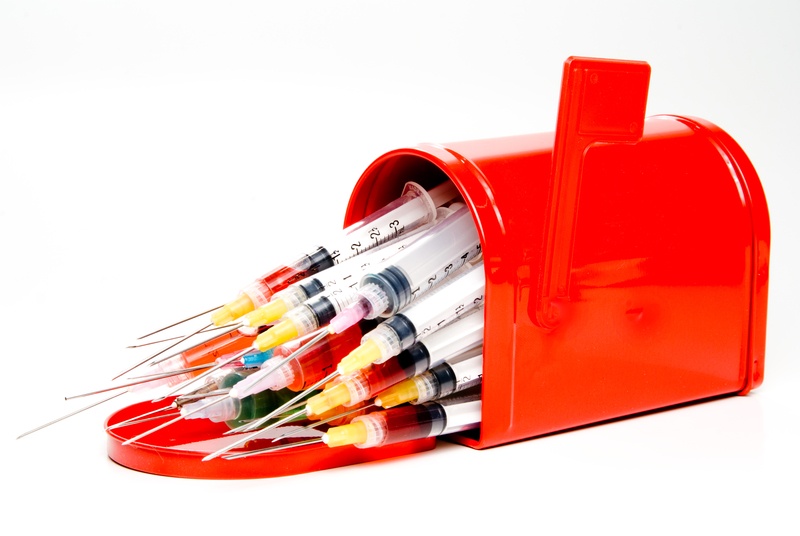

Ever since the Centers for Medicare & Medicaid Services (“CMS”) announced its DMEPOS Competitive Bidding Program there has been outcry from both providers and consumers. Particularly with respect to Competitive Bidding for the National Mail-Order Diabetic Testing Supplies Program (“National Mail-Order Program” or “Program”), which took effect on July 1, 2013, there has been a concern about the Program’s sustainability and potential for negative implications to beneficiaries. This is largely due to the low reimbursement rates, as set by the bid winning providers, and the possible spillover effect to the Medicare Part B beneficiaries’ access to quality supplies and services. While CMS had safeguards in place when the Program was implemented, many of the regulations have gone largely unenforced. Change is on the horizon as CMS strives to better police its own Program, but is it too little, too late?

In 2011, prior to the implementation of the National Mail-Order Program, CMS tested Competitive Bidding for diabetic testing supplies in nine geographical regions. In these test markets, the payment rates for a vial of test strips were reduced from $34 to $14. CMS’ goal with Competitive Bidding is to reduce costs to the Medicare Trust Fund and beneficiaries, as well as to curb fraud, waste and abuse in the industry. Wanting to ensure that the intentions of the Program were being fulfilled without repercussions, CMS conducted a study on the nine geographical test regions. In its 2012 report CMS stated that there were no negative consequences to the beneficiaries as a result of the Competitive Bidding Program.Continue reading

By: Matthew Fischer

By: Matthew Fischer

By:

By:

By:

By:

By:

By:  By: James Saling

By: James Saling By:

By: