By: Karina Gonzalez

By: Karina Gonzalez

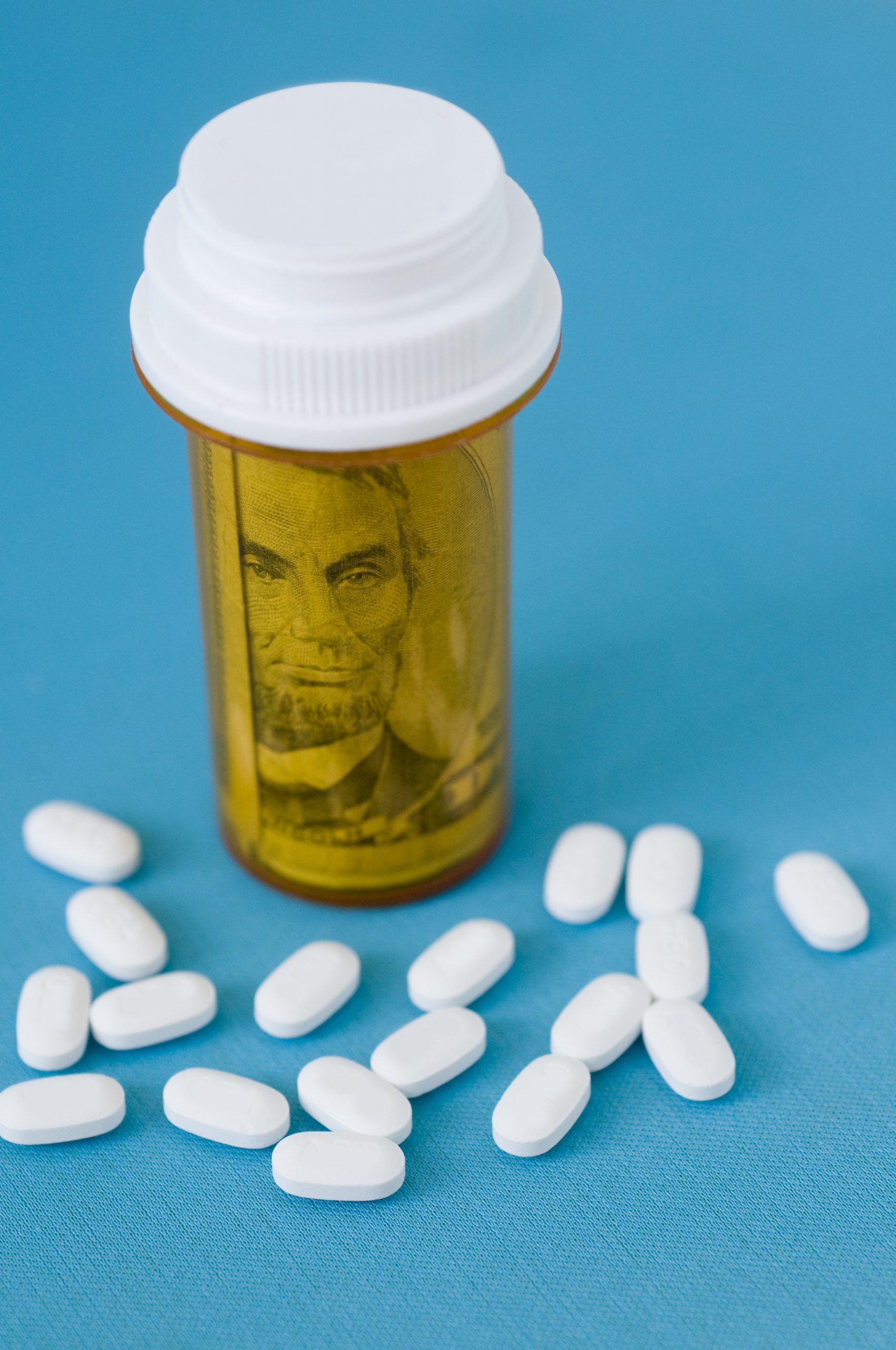

On November 15, 2019 Centers for Medicare and Medicaid Services (CMS) issued a final rule requiring hospitals to publicly disclose “standard charges, including payer-specific negotiated rates for items and services. Hospitals will be required to comply by January 1, 2021. The proposed rule is subject to 60 days of comment.

The final rule requires hospitals to make public in a machine-readable file online all standard charges (including gross charges, discounted cash prices, payer-specific negotiated charges) for all hospital items and services. It requires hospitals to de-identify minimum and maximum negotiated charges for at least 300 “shoppable” services.Continue reading

By:

By:

By:

By:

By:

By:  By:

By: